Get Involved

Our investors expect sound financial management coupled with positive community change. HCLF's record of social impact means investors get an outsized "bang for their buck" in terms of the difference their money makes in the communities where we lend.

HCLF Investment Impact

Through deep local knowledge of our target market, sound underwriting, and prudent portfolio management, HCLF helps our investors put their capital to work in our great state. No HCLF investor has ever experienced a loss.

By The Numbers

See the impact you can make! Loans Since Inception (1997). Data as of 03/31/2024

Total Loan Commitments

Affordable Units Rehabbed/Created

Jobs Created/Retained

Other Capital Leveraged since inception

Loans Made

Construction/Rehab Loans (258)

Tax Lien Foreclosure Prevention Refinancing (16)**

Small Dollar Loans (24)*

FY 2023 % of HCLF Borrowers that are Non-white

Small Business Loans (79)*

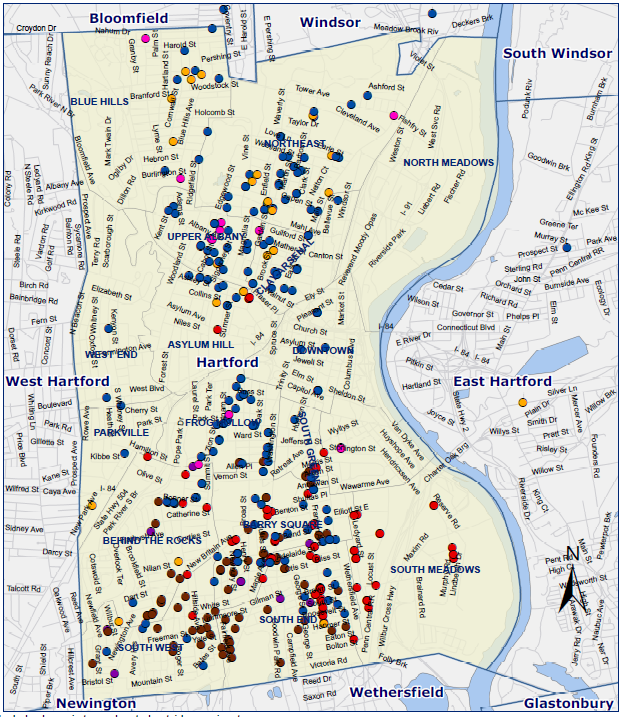

FY 2023 % Hartford Investments

Home Improvement Loans (73)*

Handicap Accessibility Grants (10)*

*No longer offered

**May also include financing for rehab efforts.

Investors

Our investors expect sound financial management coupled with positive community change. HCLF's record of social impact means investors get an outsized "bang for their buck" in terms of the difference their money makes in the communities where we lend. Through deep local knowledge of our target market, responsible underwriting, and prudent portfolio management, HCLF helps our investors put their capital to work in our great state. No HCLF investor has ever experienced a loss.

HCLF is an attractive partner for banks seeking Community Reinvestment Act credit, which encourages lending to borrowers in low-and moderate-income neighborhoods, and for other investors seeking a modest return and strong community impact.

Contact us for more information.